Risk budgeting

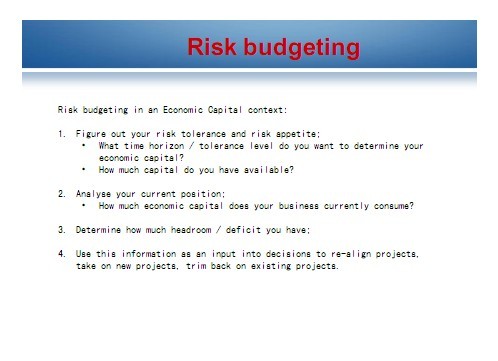

Risk budgeting in an Economic Capital context:

1. Figure out your risk tolerance and risk appetite;

What time horizon / tolerance level do you want to determine your

economic capital?

How much capital do you have available?

2. Analyse your current position;

How much economic capital does your business currently consume?

3. Determine how much headroom / deficit you have;

4. Use this information as an input into decisions to re-align projects,

take on new projects, trim back on existing projects.

The right mix

An initiative requires CNY 20bn of additional market risk capital.

How desirable is it?

Assume only two types of capital, life risk capital and market risk capital,

with correlation of 0.25

Company A has CNY 100bn of market risk capital;

Company B has CNY 100bn of life risk capital.

For Company A, the resulting capital is

CNY 20bn + CNY 100 bn = CNY 120 bn

For Company B, the resulting capital is

(1002 + 202 + 0.25 x 100 x 20)1/2 = CNY 104 bn

Company B is able to take this risk more economically.

Project appraisal

IRR is a classic way of project appraisal.

We can incorporate the cost of holding economic capital into this

analysis

The initial level of economic capital is important, but so is the run-

off.

Allowing for the cost of economic capital is a way of adjusting for risks.

Senior management & new metricsExpect senior management to be skeptical regarding any new metricsv Before the big meetings, sell the value of the ...

已下载:0次 是否免费:否 上传时间:2012-03-25

Abstract The upcoming presentation mainly discusses and delivers the following contents: l Reserve and capital l The most important measure for the...

已下载:0次 是否免费:否 上传时间:2012-03-24

The implications of insurance deregulations – International experience and lessons learned 费率市场化—国际经验分享 Lyndall Wilson, BSc, PGDip (Actuarial), FIA ...

已下载:0次 是否免费:否 上传时间:2012-03-18

Pricing for Risks: Ideals and Reality 2010 Joint Regional Seminar By Society of Actuaries, Faculty Institute of Actuaries, Institute of Actuaries of ...

已下载:1次 是否免费:否 上传时间:2012-03-10

The Global CERA CredentialA Global CredentialCERA as a Global CredentialIdea emerged from discussions at meetings of the International Actuarial Assoc...

已下载:0次 是否免费:否 上传时间:2012-03-08

Economic capital – shedding light on some issues Management and policyholder decisions Aggregation and allocation Economic scenario generators (ESGs) ...

已下载:0次 是否免费:否 上传时间:2012-03-07Copyright © 2009-2022 深圳市圈中人电子商务有限公司 粤ICP备05047908号

您是否真的需要安全退出?

确认退出